CVC

Corporate Venture Capital Investments.

We are in the midst of developing several research initiatives on corporate venture capital (CVC) investments, where an established, corporate firm takes a minority-equity position in a startup for strategic purposes (i.e., not strictly financial).

If you are a large, established corporate firm or an entrepreneurial startup, we would love the chance to meet you. Please contact us.

An integral part of creating a sustainable competitive advantage is for established corporations to acquire knowledge external to their boundaries (Anand, Capron, & Mitchell, 2005; Dess et al., 2003).

Past research has identified several ways in which established corporations acquire external knowledge. For instance, corporations have emphasized strategic alliances, joint ventures, license agreements, and mergers and acquisitions (Zhang et al., 2007).

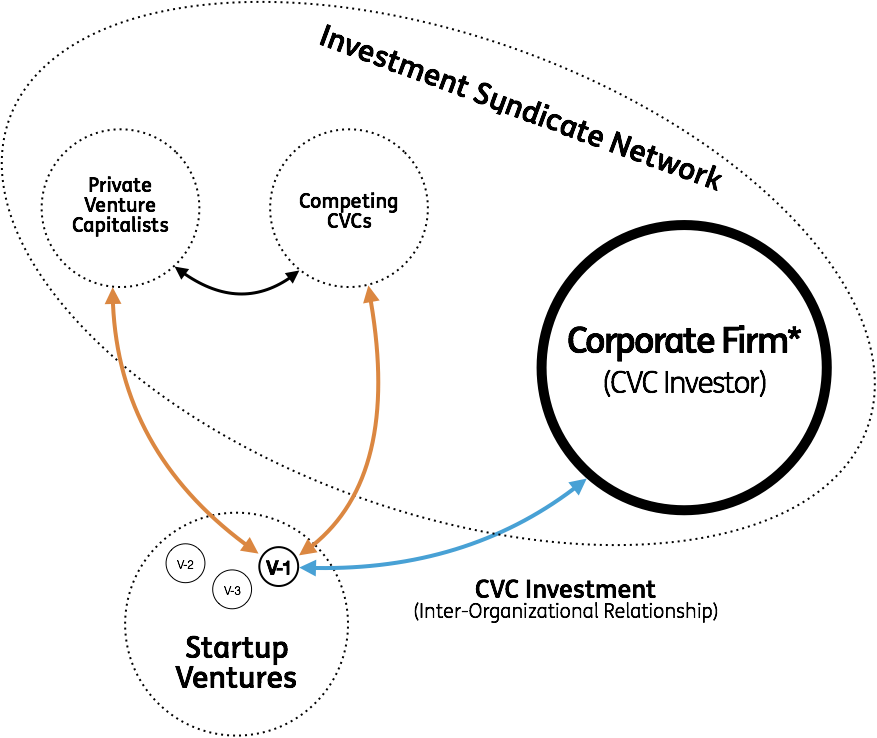

More recently, corporations have also engaged in other practices such as corporate venture capital (CVC) investments, whereby corporations make direct minority equity investments in external entrepreneurial startups in domains of future strategic importance to the focal corporation (Chesbrough, 2003; Dushnitsky & Lenox, 2005).

First deployed in the 1960s, there were as many deployments of corporate venturing programs in 2012 alone than in all the years preceding 2004 (GCV, 2014). Furthermore, investment by corporate venturers represents 16 percent of total European venture and growth capital investment. Similarly, the share of investment by corporate venturers in the U.S. constitutes 24 percent of all venture dollars invested (up from 11 percent in 2011) and 25 percent of all venture deals (CB Insights, 2015).

Strategic joint collaboration by means of CVC investments allows corporations to go beyond their “steady-states” to achieve a sustained competitive advantage, by accessing knowledge pools situated in external entrepreneurial startups (Wadhwa & Kotha, 2006).

The rationale for corporations seeking to establish inter-organizational relationships (IORs) with external entrepreneurial startups is that the latter are more likely to work on research and development (R&D) projects that are more novel and riskier than that of a corporation. The acquisition and redeployment of external technologies is an important means by which established corporations renew and extend their innovation capabilities and resources (Agarwal & Helfat, 2009; Capron & Mitchell, 2009).

In this manner, CVC investments are considered by corporations as complementary to their existing internal R&D resource bases. As knowledge recombination across organizational boundaries is consequently enacted at various levels (e.g., individuals, teams, units, organizations), CVC investments reflect Powell et al.’s (1996) observation that the locus of innovation will be increasingly developed in “networks of learning” rather than anchored inside a particular organization. It is apparent that networked individuals / teams / organizations best represents how technological and product / service innovation will be produced in the foreseeable future.

Despite the growing importance of CVC investments we know relatively little about the antecedents and outcomes of this phenomenon. Literature in the field of strategic management has seldom investigated either the formation of CVC programs or their consequences. For instance, we lack insight into how corporations organize to facilitate productive dyadic relationships between the CVC program and the corporation and between the CVC program and external startups. Specifically, there is a paucity of scholarship on how the organization of CVC affects the flow of knowledge between external startups and the corporation. The current literature treats CVC investments principally as a “black box” with an emphasis on the financial returns to startups and / or corporations. As such activities strategically complement internal R&D activities, it is worthwhile to investigate the structural and relational characteristics that facilitate knowledge recombination and make these CVC programs successful.

Working Paper. Searching Beyond the Horizon: Opportunity & Motive in CVC Investments. Eckblad, J., Devarakonda, S., Duysters, G. 2020.